How an Accounting Course Can Secure Your Job in the Evolving 2025 Market, Get BAT - Business Accounting and Taxation by SLA Consultants India

Mar 11th, 2025 at 04:41 Learning Delhi 2 views Reference: 3168Location: Delhi

Price: Contact us Negotiable

How an Accounting Course Can Secure Your Job in the Evolving 2025 Market

As we enter 2025, the accounting industry is undergoing a significant transformation driven by automation, artificial intelligence (AI), cloud accounting, and changing financial regulations. Despite the integration of technology, the demand for skilled accounting professionals remains strong, as businesses still require human expertise to manage financial data, ensure compliance, and drive strategic business growth. Enrolling in a Business Accounting and Taxation (BAT) Certification Training from SLA Consultants India can future-proof your career by equipping you with practical and in-demand accounting skills.

How an Accounting Course Can Secure Your Job in the Evolving 2025 Market, Get BAT - Business Accounting and Taxation Certification Training by SLA Consultants India

Why Is Accounting a Secure Career in 2025?

The rapid advancement of technology has automated many routine accounting tasks like data entry, bookkeeping, and financial reporting. However, critical accounting functions such as taxation, compliance, financial analysis, auditing, and decision-making still require human intervention. Businesses continue to rely heavily on accountants, tax consultants, payroll managers, and financial analysts for their financial management.

Moreover, with the introduction of Goods and Services Tax (GST), TDS compliance, and income tax regulations, skilled accounting professionals are needed to ensure that companies adhere to legal requirements. This ensures long-term job security for accountants who are trained in modern accounting practices.

How BAT Certification Can Secure Your Career

The BAT - Business Accounting and Taxation Certification Training offered by SLA Consultants India is designed to equip learners with hands-on knowledge of accounting tools, taxation laws, and financial compliance. The course covers key modules such as:

- Financial Accounting & Reporting – Learn the fundamentals of accounting, balance sheets, profit and loss statements, and financial analysis.

- GST & Taxation Management – Gain practical knowledge of GST return filing, TDS compliance, and income tax calculations.

- Tally Prime & Advanced Excel – Master essential accounting software for bookkeeping, invoicing, and financial reporting.

- Payroll Processing & Compliance – Learn payroll management, EPF, ESI, professional tax calculations, and labor law compliance.

- Income Tax & Audit Filing – Understand taxation procedures, filing income tax returns, and preparing financial audits.

100% Job Placement Assistance

One of the major benefits of enrolling in the BAT Certification Course is the 100% Job Placement Assistance provided by SLA Consultants India. This ensures that learners can seamlessly transition into high-demand job roles like Accountant, GST Practitioner, Financial Analyst, Tax Consultant, and Payroll Executive in top companies.

Secure Your Future Today

In the evolving 2025 market, accounting professionals who stay ahead of tax regulations, financial compliance, and data-driven decision-making will have the highest job security. By enrolling in the Accounting Course in Delhi from SLA Consultants India, you will gain practical skills and certification that can open doors to high-paying and stable accounting jobs.

Enroll Today and secure your accounting career with BAT Certification Training from SLA Consultants India.

SLA Consultants How an Accounting Course Can Secure Your Job in the Evolving 2025 Market, Get BAT - Business Accounting and Taxation Certification Training by SLA Consultants India Details with "New Year Offer 2025" are available at the link below:

https://www.slaconsultantsindia.com/accounts-taxation-training-course.aspx

https://slaconsultantsdelhi.in/training-institute-accounting-course/

Accounting, Finance CTAF Course

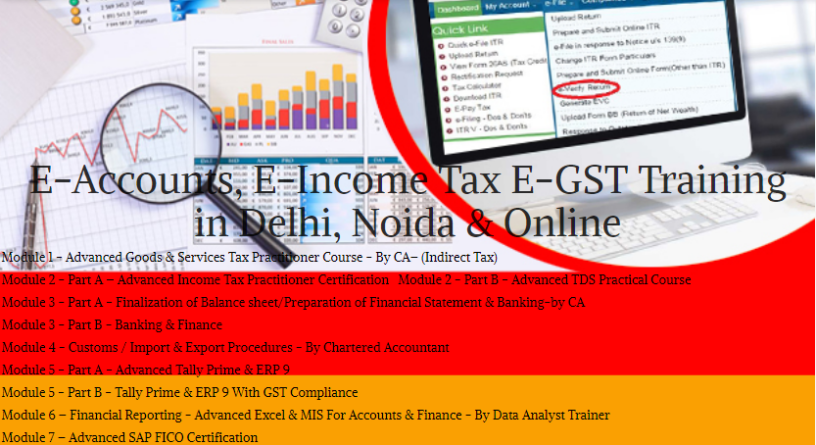

Module 1 – Advanced Goods & Services Tax Practitioner Course - By CA– (Indirect Tax)

Module 2 - Part A – Advanced Income Tax Practitioner Certification

Module 2 - Part B - Advanced TDS Practical Course

Module 3 - Part A - Finalization of Balance sheet/Preparation of Financial Statement & Banking-by CA

Module 3 - Part B - Banking & Finance

Module 4 - Customs / Import & Export Procedures - By Chartered Accountant

Module 5 - Part A - Advanced Tally Prime & ERP 9

Module 5 - Part B - Tally Prime & ERP 9 With GST Compliance

Module 7 – Advanced SAP FICO Certification

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No.52,

Laxmi Nagar, New Delhi - 110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/

![Top Data Analysis Training Centers in Delhi, 110010 - "New Year Offer 2025" Free Tableau and "Data Science Course" [with Google Certificates]](https://onlinebestads.com/storage/files/in/2754/thumb-320x240-b5786469943bbcd0575c06bc1f57bea1.png)